in 2013, Vivek Gambhir (Gambhir) took a market visit to Kurukshetra, Haryana, soon after he took over as the Managing Director of Godrej Consumer Products Ltd., (GCPL). During his visit he visited a small kirana store, the owner walked up to him with a sachet of Godrej Expert Rich Hair Crème, a hair color. Gambhir was surprised and expressed amazement that GCPL could offer premium products at an affordable `30. The smallest pack of any basic rival product cost no less than `60. The retailer remarked, “You are launching innovative products almost every quarter when the rest are cutting spends.”1 A couple of years ago, when GCPL was looking at upgrading consumers from powder hair dyes to crème hair dyes, it hit a roadblock on the price factor. It was a market leader in the powder hair dye segment but lost its

market in the crème hair dye segment.2

Traditionally priced high in India, crème based salon-style dyes have always been perceived to be efficacious by consumers. GCPL saw an opportunity in this segment and introduced ‘Godrej Expert Rich Hair Crème’ at a minimum price of `30! To drive home the brand’s association with style and fashion, model and entrepreneur Perizad Zorabian was roped in for the ads. Since its launch ‘Godrej Expert Rich Hair Crème’ struck a chord with the consumers and became an instant success. What made consumers to decide in favor of GCPL’s Expert Rich Hair Crème?

Hair Dye – The Genesis

Hair colour history can be traced back to 27 BC. Tools and dyes pertaining to men coloring their hair were unearthed by archaeologists at sites in the Middle East. Red appeared to be the color of choice and it most possibly was used to rank people in society. Since life expectancy was short, it is unlikely that it was ever used to cover grey.3

In India, although conventional henna was used for hair coloring for long time now, it was Godrej that created the hair color category in 1974, with its ‘Godrej Liquid Hair Dye’. Packaged in bottles, this product was a runaway success, so much so that the term ‘dye’ itself became synonymous with Godrej.4 Used in those days with some degree of hesitation, it became a category leader and laid the foundation for the market-to-come. Keeping abreast with the change in the emerging styles, preferences and the consumer needs, Godrej launched ‘Godrej Hair Dye’ in a powder format in 1981. It revolutionized the market by packaging its hair dye in an economical, easy-to-use, convenient-to-carry sachet format called Godrej Powder Hair Dye (Exhibit I).

| Exhibit I: Godrej Powder Hair Dye |

| |

In price sensitive rural India, it had an open sesame effect. Its USP put succinctly in its communication – Kaato Gholo Lagaalo (cut, dissolve, apply) – helped it establish unprecedented leadership.5 Godrej as a pioneer in the field was first off the block when hair dye advertising was finally deregulated in the early 1990s which made, hair dyeing activity a high involvement activity in India.

The first Godrej hair dye commercial termed ‘Aunty-Didi’ was based on the researched premise that no woman likes to be called ‘aunty’.6 The tagline of the next television spot Kaato Gholo Lagaalo made Godrej a flagship brand in Indian hair dye market. The commercial made an instant connect with the target group and powered its way into advertising memorabilia.7 Changes in consumer profile are reflected in the products and the ads that support them. The choice of Katrina Kaif, for instance, as the brand ambassador for Godrej Renew reflects this shift.8

| Exhibit II: Brand Shares By Value (in%) 2012 | |||||

| Brand | Company | 2009 | 2010 | 2011 | 2012 |

| Godrej Hair Dye | Godrej Consumer Products Ltd. | 26.0 | 25.8 | 24.2 | 23.3 |

| Super Vasmol | Hygienic Research Institute | 17.0 | 16.0 | 15.8 | 15.6 |

| L’Oréal Excellence Crème | L’Oréal India Pvt. Ltd. | 10.8 | 10.8 | 10.8 | 10.9 |

| Garnier Colour Naturals | L’Oréal India Pvt. Ltd. | 5.0 | 5.3 | 5.6 | 5.6 |

| Indica | Cavinkare Pvt. Ltd. | 4.0 | 4.2 | 4.3 | 4.6 |

| Godrej Coloursoft | Godrej Consumer Products Ltd. | 4.0 | 4.3 | 4.5 | 4.6 |

| Streax | Hygienic Research Institute | 2.3 | 2.0 | 2.0 | 2.0 |

| Revlon Colorsilk | Modi Revlon Pvt. Ltd. | 0.9 | 0.9 | 0.7 | 0.6 |

| Others | Others | 30.0 | 30.7 | 32.1 | 32.8 |

| Total | Total | 100.0 | 100.0 | 100.0 | 100.0 |

| Source: “Godrej Expert Hair Colour”, http://fcbulkacomstrat.in/comstrat_case_study2013.html, 2013 | |||||

The Hair Color Market in India

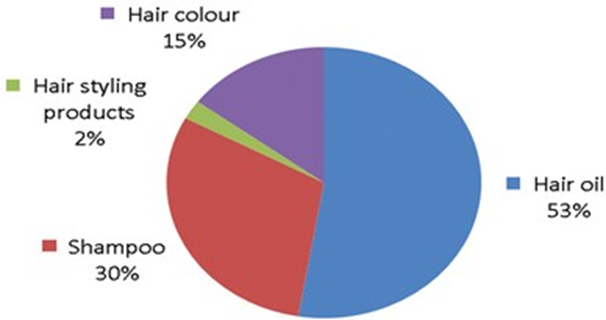

The hair care market was estimated at around `152 billion in 2013-2014. The hair color segment accounts for around 15% of the total hair care market (Exhibit III). Penetration level of hair color is estimated at over 35% in India9 and hair colorants have proven to be the hair care industry’s crowning glory. The hair color industry grew by more than five times in the last 10 years and is currently growing at 15% year-on-year10.

According to data from research agency Euromonitor, the color cosmetics category in India grew 29% by value in 2011 to reach `2,250 crore. Sales in the category are expected to reach `4,760 crore by 2016.11 The delivery formats of the hair colorants are available in Powder-based, Cream-based, Oil-based emulsion,

Shampoo-based and Liquids with different players in different segments. Of these, powders comprise the biggest segment controlling nearly a third by value.12 GCPL is the category leader with a market share of 34%.13 For GCPL the hair color segment accounts for 23% of the net sales of the company.14

Hair color in India is one-tenth of the soap market by value. This is in sharp contrast to the rest of the world where hair color is actually twice its size. Industry research attributes this to the fact that only 20% of Indian women use hair color as compared to 90% in developed markets.15 The industry insiders forecast the segment to reach its full growth potential due to various contributing factors and key drivers (Exhibit IV)

| Exhibit IV: Hair Color Market Key Drivers | |

| 1 | Once an occasion-linked beauty regimen now a way of life! |

| 2 | Change in the conventional hair care and hair styling methods to modern styles as the access to global trends had increased |

| 3 | Men are fast emerging as a separate consumer category in a market traditionally dominated by women |

| 4 | Availability of (At Home) Do-it-yourself (DIY) colorants at affordable prices and the ‘salon-like hair’ value proposition they promise |

| 5 | Rise in disposable income of the consumers leading to spend on high-quality hair care products/brands and afford salon services like hair spas, straightening |

| 6 | Tremendous rise in organized retail |

| 7 | Paradigm shift from conventional black to other colors |

| 8 | An expanding distribution network ensures that more and more people have access to these products |

| 9 | Product innovation availability of the same in smaller packs/sachets |

| Source: Priyanka Bhattacharya, “Paradigm Shift for India’s Hair Care”, http://www.gcimagazine.com/marketstrends/regions/bric/27779339.html?page=1, September 2nd 2008 | |

Dyeing and Consumer Decision-Making

Hair Color was primarily used to cover grey hair till the late ’80s. However, in the last decade, it has emerged as a fashion statement. The streaked hair and glossy rich colored tresses, which used to be the fancy of the rich and famous, now reached to the masses.16 ‘Premature greying’ is a factor which is hardly ignored and is playing an instrumental role in driving the potential of this market. Bengaluru-based Dermatologist Dr. Mukta Sachdev (Sachdev) observes increasing numbers of children and young teens with greying hair and says “It definitely affects your self-esteem as grey hair has been traditionally associated with ageing.”17 Dr. Anjali Chhabria, Psychiatrist, Psychotherapist and Founder of Mindtemple in Mumbai, feels, “greying hair can lead young women to feel depress, overly self-critical and self-conscious, especially in social gatherings. It can lead to unhealthy coping strategies such as eating disorders or body image disorders.”18

In India, industry insiders opine that, due to other pressing issues like time constraints (to visit the salon as well as a grocery store), touch ups (instead of full application), etc., most of the hair dyeing process is practiced at home. There could be many factors that a consumer would consider to go for a specific hair dye

brand (Exhibit V). In DIY segment GCPL is the category leader with a market share of 33%19. Price of Hair Dye was a major consumer decision touch point especially for the hair color crème variants.

| Exhibit V: Influencing Factors In Buying Hair Dyes | |

| Factor | Classification |

| Factors considered for Hair dye selection | Brand Name |

| Content | |

| Color Range | |

| Availability | |

| Price | |

| Decision Influencer | Safety |

| Price | |

| Safety | |

| Friends | |

| Relatives | |

| Ads | |

| Source: Dr.Rahela Tabassum and Aruba Zubedi, “An Empirical Analysis of Attribute Importance in Selection of Hair Dyes- Issue and Perspectives”, IJISET, International Journal of Innovative Science, Engineering & Technology, Volume 1, Issue 10, http://www.ijiset.com/v1s10/IJISET_V1_I10_88.pdf, December 2014 | |

GCPL embarked on research on how it could upgrade powder dye users to a reasonable price point. It found that the resistance for upgrading to hair colors was not just the price point. Consumers found it cumbersome to get the right proportions while mixing the colors. Also, Godrej wanted the experience of consumers upgrading from powder dyes to be as superior as those consumers who bought top-end hair color brands that cost more than `500 per pack. That was asking for too much.20

Godrej is not new to innovations! Long back in 1995 it revolutionized the market by packaging its hair dye in an easy to-use, convenient-to-carry sachet format. The sachet format in fact poses a very special challenge, for hair color begins to rapidly oxidize when it comes in contact with air.21 In the crème segment also GCPL wanted to innovate by offering premium value proposition by introducing crème hair dye at powder dye price points. When a consumer is deciding upon purchasing a product, his decisions are affected by brand image and its influence on perceived value, quality and risk as well. The risks perceived by a consumer can be lowered if the brand is able to build a better positive image.22 Experts opined that, consumers’ perceived value was good for the ‘powder hair dye’ category.

Commenting on offering the premium value proposition, Gambhir observed that group Chairman Adi Godrej was certain that the upgrade was necessary. But unlike rival companies, which were rushing to give their brands premium status, GCPL took a calibrated approach. It decided to upgrade consumption habits at the bottom of the pyramid by offering quality products at value prices. He says “The idea was to delight customers with an affordable product without compromising on quality. We brought costs down mostly through packaging innovations.”23

Powder hair dye sachets are available at a price as low as `9 per sachet, cream-based colors are priced in the range of `80 – `100 while comparable brands like L’Oréal Excellence costs about `500 per pack.24 Speaking on the efficacy of launching crème based hair dye at lower price point Nisaba Godrej, Executive Director, GCPL said, “We see what our consumers’ needs are, and how we can differentiate. For instance, the only reason a mass consumer will not use Crème -based hair color is because of its price. So we found a way to reduce the cost by packaging it in a sachet. We are price disrupting, but at the same time we are offering a premium product.”25

Godrej Expert Rich Crème – 5Ps Product & Price

In India, brands like L’Oréal Professionnel, followed by Schwarzkopf and Wella, dominate the salon/ professional market. This segment has seen steady growth, predominantly in the metropolitan market since the tier two market consumers were a bit slow in upgrading to salon services.26 In order to tap the crème market, Godrej introduced the Expert hair color range in 2012 (Exhibit VI) which comes in five different shades (Natural Black, Dark Brown, Black Brown, Natural Brown and Burgundy).

| Exhibit VI: Five Shades of Godrej Expert Rich Crème |

| |

| Source: Lisha B, “Godrej Expert Rich Crème Hair Color Natural Brown 4.0 Review”, http://www.heartbowsmakeup.com/godrej-expert-rich-creme-hair-color- natural-brown-review/, June 13th 2014 |

For the first time in India, Godrej offered a crème hair color available in convenient pre-measured sachets, while the other market players (Exhibit VII) offered the same in stylized bottles at higher price points. Godrej Expert Rich Crème is enriched with the goodness of aloe-protein which keeps the hair soft & shiny. According to GCPL, Godrej Expert Rich Crème was deemed superior to other available crème colors in blind consumer tests.27 In November 2013, GCPL announced 24% quarterly growth in hair colorants,

| Exhibit VIII: Godrej Expert Rich Crème – Oh My God – TVC |

| |

| Source: “Godrej Expert Rich Creme – Oh My God”, https://www.youtube.com/watch?v=oc-SSYh-ARI, November 26th 2012 |

Packaging

Godrej Expert Rich Crème comes in two different packs at two different price points – `30 and `59. While

`59 pack offers a complete one-stop solution by way of a Hair Coloring Kit (color sachet + developer sachet

+ hair coloring brush + mixing bowl + gloves + ear caps + stain removal wipe + conditioner) the `30 pack does not come with the Hair Coloring Kit. This `30 crème sachet, also a 40ml pack, (Exhibit IX) say market experts, is likely to be a game changer against this backdrop.

| Exhibit IX: Godrej Product Price Stats | ||

| Product | Price | Format |

| Godrej Expert Original | `15/sachet | Powder |

| Godrej Expert Advanced | `15/sachet | Powder |

| Godrej Expert Care | `20/sachet | Powder |

| Godrej Expert Rich Crème | `30/sachet `59 (for the kit) | Cream |

| Source: “Godrej Expert Hair Colour”, http://fcbulkacomstrat.in/comstrat_case_study2013.html, 2013 | ||

Godrej Expert Rich Crème appeals to both existing powder color users and category first-timers, and promises an improved experience for current crème users.31 To provide the necessary retailing traction, given the value-for-money price points (`30 and `59), GCPL adopted a counter intuitive strategy.

Place

Industry experts opine that, most of the time personal care products are bought by the servants or the maids of the households.32 The neighborhood general store continues to be the most popular purchase location for personal care products. Department stores, women’s boutiques and salons are emerging as new purchasing destinations in urban areas. Yet, more than half of urban consumers have never shopped for personal care in

| Exhibit X: Godrej Expert Rich Crème – Consumer Feedback | |

| 1 | As my mom-in-law did the patch test before and did not feel any allergy or unpleasant sensation, her overall experience was fine except for a little hair fall. Her hair looked noticeably soft and shiny after wash, hats off to the presence of aloe in the ingredient list. Given this hair color is Crème- based and ammonia free gives Godrej an edge over other brands with similar products that are highly expensive and not so readily available. |

| 2 | I have been using L’Oréal Excellence Crème Permanent Hair Color (Shade 4.0) for a long time now and have survived one really bad scalp allergy last year. I tried Godrej Expert Rich Crème. Once out of the shower, I started feeling nausea and giddiness. The heat sensation in my scalp aggravated further. It was not a burning sensation but as if very intense heat waves were coming out of my scalp. I tried lying down but the giddiness became worse. For 2 hours, my condition was really bad. After that the giddiness subsided slowly but the high-heat sensation in the scalp remained for more than 24 hours. |

| 3 | I have been coloring my hair for many years and am at present using Godrej Expert Rich Crème. The best part of it for me is that it is ammonia free. I have had no unpleasant reaction. (For others would suggest a spot sensitivity check and on the slightest unpleasant experience to wash off quickly with cool water.) Have found the brown shades to be too dark. Covering is temporary but that is Ok because in any case new growth means dye has to be applied every fortnight or so. |

| 4 | Please do a strand test first and don’t go for a full head application. You can apply at home and no need to go to a salon as the salon guys will convince you for a full head application with a permanent color which may increase your greys over time. For semi-permanent hair colors, you will need to choose a color close to or darker than your current natural hair shade, lighter colors won’t work. Also, switch to a non-SLS shampoo when you start coloring otherwise hair quality will degrade over time. For further help, become a member and then you can e-mail me. |

| 5 | In India it is quite common (even in parlors) that they take approx quantities of colorant and developer and mix to save the product for second use. I was a bit wary of that and also price conscious as it is expensive and if I go by instructions I have to use the full product unnecessarily and discard the remaining. Hence, I found Godrej’s approach convenient. I didn’t go for Garnier as it is not ammonia-free. |

| 6 | Sometimes we need to just touch up and need not go for full head application. At this point, it’s best to use Godrej Expert Rich Crème which are available in sachets instead of going for expensive brands |

| 7 | “I liked the shade, as it is close to my natural hair colour, my hair seems softer now. I have a sensitive scalp and unlike other products I did not experience any itching sensation after application” |

| Compiled by the authors from the following sources: Anshulika Chawla, “Godrej Expert Rich Creme Hair Color Review; Truly a Wow Hair Color”, http://road2beauty.com/2014/01/godrej-expert-rich-creme-hair- color-review-truly-a-wow-hair-color/, February 3rd 2014 (accessed date: May 12th 2015) Sunshine Diva Gaganpreet, “Godrej Expert Rich Creme Hair Colour Natural Brown 4.00 Review”, http://www.reviewsandlifestyle.com/2013/04/godrej-expert- rich-creme-hair-colour-review.html, April 30th 2015 “Meet the Godrej Expert Rich Creme Hair colour head turners”, http://godrejcp.com/media/press_release/87-meet-the-godrej-expert-rich-creme-hair-colour- head-turners.aspx, August 25th 2013 | |

Assignment Questions

- What according to you is the nature of Hair Dyeing products? Are they FMCGs or Consumer Durables? Explain with reasons. Of all the three decision-making levels (EPS, LPS and RPS), which of the decision- making approaches do you think a ‘Hair Dye’ consumer would apply? Using the case facts (including exhibits) analyze the level of decision-making in the case of their dyeing habits.

- While the consumer decision-making literature highlights four views of consumer decision-making, which view do you think is most appropriate to a Hair-Dye product-buying consumer?

- What is your take on the entire consumer buying decision process of Godrej Expert Rich Crème with respect to the consumer feedback (Exhibit X of the case study) and analyze the same from the point of view of ‘Input, Process & Output’ model of consumer decision-making?

Well researched work

Informative article

Excellent Case